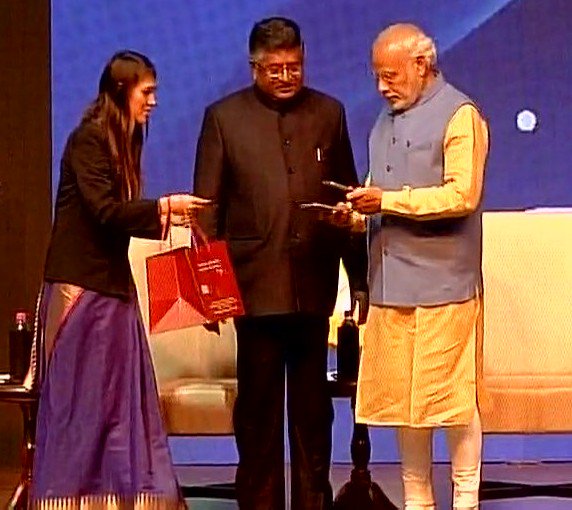

PM @NarendraModi launches a mobile app #BHIM to make digital payments easier at #DigiDhanDelhi

Today at #DigiDhanDelhi event PM @narendramodi launched a mobile app #BHIM to make digital payments easier.

Bharat Interface for Money (BHIM) is an initiative to enable fast, secure, reliable cashless payments through your mobile phone. BHIM is interoperable with other Unified Payment Interface (UPI) applications, and bank accounts. BHIM is developed by the National Payment Corporation of India (NPCI). BHIM is made in India and dedicated to the service of the nation.

App link: https://play.google.com/store/apps/details?id=in.org.npci.upiapp&rdid=in.org.npci.upiapp&pli=1

We've curated some of the interesting conversations about it.

image credit: @NitiAayog

ps: This content is curated by eChai Team from public posts on social media platforms. In case if you have any queries, then email us at [email protected]

How BHIM Works?

How does it work?

Register your bank account with BHIM, and set a UPI PIN for the bank account. Your mobile number is your payment address (PA), and you can simply start transacting. Yes! It is that simple.

Send / Receive Money: Send money to or receive money from friends, family and customers through a mobile number or payment address. Money can also be sent to non UPI supported banks using IFSC and MMID. You can also collect money by sending a request and reverse payments if required.

Check Balance: You can check your bank balance and transactions details on the go.

Custom Payment Address: You can create a custom payment address in addition to your phone number.

QR Code: You can scan a QR code for faster entry of payment addresses. Merchants can easily print their QR Code for display.

Transaction Limits: Maximum of Rs. 10,000 per transaction and Rs. 20,000 within 24 hours.

Language supported: Hindi and English. More languages coming soon!

Supported Banks: Allahabad Bank, Andhra Bank, Axis Bank, Bank of Baroda, Bank of India, Bank of Maharashtra, Canara Bank, Catholic Syrian Bank, Central Bank of India, DCB Bank, Dena Bank, Federal Bank, HDFC Bank, ICICI Bank, IDBI Bank, IDFC Bank, Indian Bank, Indian Overseas Bank, IndusInd Bank, Karnataka Bank, Karur Vysya Bank, Kotak Mahindra Bank, Oriental Bank of Commerce, Punjab National Bank, RBL Bank, South Indian Bank, Standard Chartered Bank, State Bank of India, Syndicate Bank, Union Bank of India, United Bank of India, Vijaya Bank.

For more information: visit https://upi.npci.org.in/static/faq/en_US/

Pankaj Bengani

Am already using another UPI app, but found #BHIM very simple to use. So it is promising for sure.